Why VA Home Loans Are the most effective Mortgage Choice for Experts

Why VA Home Loans Are the most effective Mortgage Choice for Experts

Blog Article

Understanding How Home Loans Can Promote Your Journey In The Direction Of Homeownership and Financial Stability

Browsing the complexities of home financings is necessary for anybody striving to attain homeownership and establish financial stability. As we consider these critical aspects, it ends up being clear that the path to homeownership is not just regarding safeguarding a funding-- it's concerning making educated choices that can shape your financial future.

Kinds Of Home Loans

Conventional financings are a prominent alternative, usually requiring a higher credit rating and a deposit of 5% to 20%. These finances are not insured by the government, which can result in more stringent credentials criteria. FHA car loans, backed by the Federal Housing Administration, are made for first-time buyers and those with reduced credit report, permitting for down repayments as reduced as 3.5%.

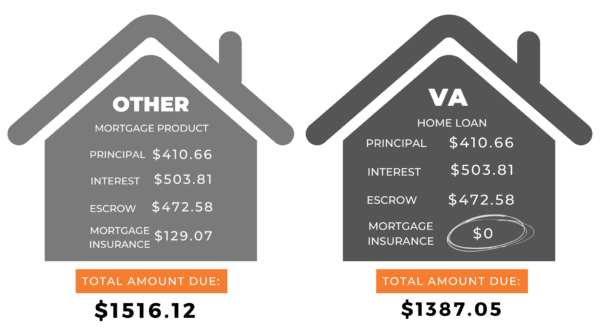

VA fundings, available to professionals and active-duty army employees, use positive terms such as no personal home loan and no down payment insurance coverage (PMI) USDA financings satisfy rural buyers, advertising homeownership in much less largely inhabited locations with low-to-moderate earnings degrees, likewise calling for no deposit.

Lastly, adjustable-rate home mortgages (ARMs) provide lower initial prices that readjust gradually based on market conditions, while fixed-rate home loans give secure regular monthly settlements. Recognizing these choices enables prospective property owners to make enlightened decisions, aligning their economic goals with one of the most appropriate loan type.

Comprehending Rate Of Interest

Rates of interest play a pivotal duty in the home mortgage process, dramatically influencing the general expense of loaning. They are essentially the expense of obtaining money, shared as a portion of the lending quantity. A reduced interest price can lead to significant savings over the life of the lending, while a greater rate can result in boosted monthly payments and total passion paid.

Passion prices change based on various aspects, consisting of economic problems, rising cost of living rates, and the monetary policies of central banks. A fixed rate continues to be consistent throughout the finance term, offering predictability in monthly payments.

Recognizing how interest prices work is vital for prospective home owners, as they straight influence affordability and financial preparation. It is a good idea to compare rates from various lenders, as even a minor difference can have a significant impact on the complete expense of the financing. By keeping abreast of market patterns, borrowers can make enlightened choices that straighten with their monetary goals.

The Application Process

Browsing the home funding application process can initially appear complicated, however understanding its crucial parts can simplify the journey. The initial step includes celebration necessary documentation, consisting of proof of income, tax obligation returns, and a checklist of assets and liabilities. Lenders need this info to evaluate your financial stability and credit reliability.

Following, you'll require to select a lending institution that aligns with your economic demands. Research different home loan items and rate of interest prices, as these can considerably influence your monthly repayments. Once you choose a lending institution, you will finish an official application, which may be done online or in person.

As soon as your application is accepted, the loan provider will certainly release a funding price quote, outlining the prices and terms connected with the home mortgage. This crucial document enables you to assess your choices and make educated choices. Successfully browsing this application process lays a solid structure for your trip towards homeownership and monetary stability.

Handling Your Home Mortgage

Managing your mortgage successfully is important for maintaining economic health and guaranteeing long-lasting homeownership success. A proactive approach to mortgage administration entails comprehending the regards to your finance, including rate of interest, payment timetables, and any prospective fees. Frequently reviewing your home loan declarations can help you remain educated concerning your staying balance and payment background.

Producing a budget plan that accommodates your mortgage payments is important. Make sure that your regular monthly budget consists of not just the principal and interest but also residential property tax obligations, house owners insurance, and maintenance prices. This thorough view will prevent economic stress and unforeseen costs.

This approach can considerably decrease the complete passion paid over the life of the lending and shorten the repayment duration. It can lead to reduce regular monthly repayments or a much more beneficial financing term.

Last but not least, keeping open communication with your lender can provide clearness on alternatives offered must monetary difficulties emerge. By actively managing your mortgage, you can enhance your monetary stability and strengthen your course to homeownership.

Long-Term Financial Conveniences

Homeownership provides substantial long-term economic advantages that expand past mere shelter. Among one of the most substantial advantages is the potential for property appreciation. In time, genuine estate typically values in value, allowing homeowners to build equity. This equity serves as a monetary property that can be leveraged for future financial investments or check out this site to finance major life events.

In addition, homeownership supplies tax advantages, such as home mortgage interest reductions and home tax reductions, which can considerably minimize a house owner's gross income - VA Home Loans. These reductions can lead to substantial cost savings, boosting overall monetary security

In addition, fixed-rate home loans shield home owners from climbing rental expenses, making certain predictable regular monthly repayments. This stability permits people to spending plan properly and strategy for future costs, helping Get More Info with long-lasting monetary goals.

Homeownership additionally fosters a feeling of area and belonging, which can lead to increased public involvement and assistance networks, even more adding to financial health. Inevitably, the economic advantages of homeownership, consisting of equity growth, tax obligation benefits, and cost security, make it a keystone of long-lasting monetary safety and security and riches accumulation for households and individuals alike.

Verdict

In conclusion, comprehending home finances is essential for browsing the path to homeownership and attaining economic security. Furthermore, reliable home loan administration and recognition of long-term financial benefits add significantly to developing equity and cultivating area interaction.

Navigating the intricacies of home car loans is crucial for anybody aiming to attain homeownership and develop monetary stability. As we consider these crucial elements, it becomes clear that the path to homeownership is not just concerning securing a car loan-- it's about making informed choices that can form your monetary future.

Recognizing exactly how passion prices function is crucial for possible property owners, as they directly affect cost and economic planning.Handling your home loan effectively is necessary for preserving monetary health and making certain long-term homeownership success.In conclusion, recognizing home fundings click to investigate is essential for navigating the course to homeownership and attaining financial security.

Report this page